1. [PDF] AMERICAN EXPRESS - Chargeback Codes

Proof that links the Card Member to each Charge processed and proves that all of the Transactions are valid. • Evidence that this Chargeback was raised in error ...

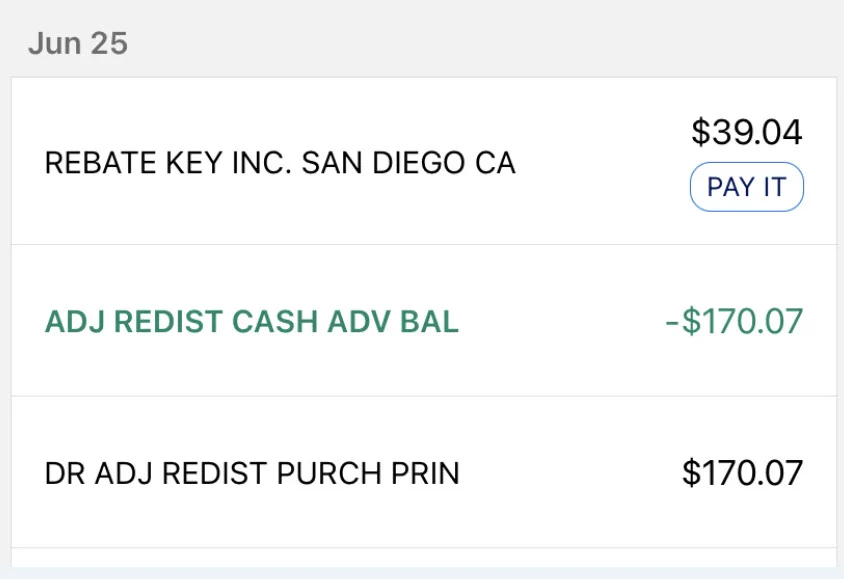

2. 아맥스 플랫에 알 수 없는(?) 알기 힘든 transactions 이거 뭐죠? DR ADJ ...

23 nov 2021 · 처음에는 fraud인가 했는데 같은날 charge되었다가 다시 credit으로 넣어주었네요. 11/19 DR ADJ REDIST CADV PRIN $176.51. 11/19 ADJ REDIST PURCHASE ...

처음에는 fraud인가 했는데 같은날 charge되었다가 다시 credit으로 넣어주었네요. 11/19 DR ADJ REDIST CADV PRIN $176.51 11/19 ADJ REDIST PURCHASE BAL -$176.51 이게 무엇일까요? Internal 용도인것 같긴한데. ...

3. AMEX 信用卡上出现奇怪消费(DR ADJ REDIST CADV PRIN)

16 nov 2021 · 之前看到 AMEX 卡上出现了奇怪的 charge,先被 charge 了 $100,然后又发了 $100 的 credit。一开始我还以为是买了东西的退款,但是看了下这个 charge ...

之前看到 AMEX 卡上出现了奇怪的 charge,先被 charge 了 $100,然后又发了 $100 的 […]

4. Transactions downloaded from American Express credit card are ...

31 okt 2023 · Dr Adj Redist. 6818 Miscellaneous. $120.60. My actual transaction on my ... charges on card one are also showing up on card 2 now. I do ...

Transactions downloaded from American Express credit card are incorrect. I have an alert that QB is working to resolve the issue. Can I get an update?

5. DR ADJ REDIST CADV PRIN - Business Finance

DR ADJ REDIST CADV PRIN is a line item from AMEX that represents a temporary charge against the cardholder. It is an internal adjustment that is later ...

DR ADJ REDIST CADV PRIN AMEX Charge Table Of Contents Open The Table Of Contents DR ADJ REDIST CADV PRIN AMEX Charge AMEX Internal Transaction The Statement AMERICAN EXPRESS INTERNAL TRANSACTION DR ADJ REDIST CADV PRIN is a line item from AMEX that represents a temporary charge against the cardholder. It is an internal adjustment ... Read more

6. AMEX "Credit & Debit Adjustment" - myFICO® Forums - 2009103

29 mrt 2013 · I have an AMEX Gold card and there is a $86.65 debit adjustment and Jen a $86.65 credit adjustment for the same day (3/22/13). Has anyone ever ...

Anyone know what this is about? I have an AMEX Gold card and there is a $86.65 debit adjustment and Jen a $86.65 credit adjustment for the same day (3/22/13). Has anyone ever seen or got this before?

7. DR ADJ REDIST CADV PRIN Charges! Discover The Mysteries

6 jun 2024 · Meanwhile, American Express has a specific temporary charge against the cardholder called DR ADJ REDIST CADV PRIN. ... You dispute an AMEX charge ...

Perhaps an unusual charge that baffled you on your account statement has appeared. It might have been a bewildering code like "DR ADJ REDIST CADV PRIN" or "ADJ Redist Purchase Bal."

8. What are DR ADJ REDIST CADV PRIN Charges? - Famus Fece

12 jun 2024 · Does this charge Have an Impact on Account Balance? Account Adjustments as an AMEX Internal Transactions; FAQs; Final Thoughts. What is ADJ ...

The coded charges puzzle adjustments maintain account accuracy without costing customers.

9. DR ADJ REDIST CADV PRIN Charges! Unlock the Mystery

19 mei 2024 · Let's start by deciphering the code itself. “ADJ REDIST Purchase Bal” is a charge commonly associated with American Express (AMEX) statements.

In decoding "DR ADJ REDIST CADV PRIN Charges," clarity triumphs over mystery, empowering informed financial management.

10. Credit Adjustment, Debit Adjustment - Amex Gold Biz - FlyerTalk Forums

30 aug 2015 · Is it 1/3, 1/4 or another fraction of the annual fee? Duffman , Jan 19, 2016 8:48 pm.

American Express | Membership Rewards - Credit Adjustment, Debit Adjustment - Amex Gold Biz - Every 3-4 months, I have two line items on my Amex Gold Business card statement. One a credit for $XX.YY and right after that a debit for $XX.YY. No impact to my bottom line. I've called Amex about this a couple of times and

11. DR ADJ MC PURCHASE - What's That Charge?!

10 jan 2023 · DR ADJ MC PURCHASE. Learn about the "Dr Adj Mc Purchase" charge and why it appears on your credit card statement. First seen on March 15, ...

First seen on March 15, 2015, Last updated on January 10, 2023

12. What is a credit balance refund on the American Express Platinum card?

22 nov 2021 · Most Amex credit cards allow you to carry a balance from month to ... charge. Advertising does not impact WalletHub's editorial content ...

A credit balance refund on the American Express Platinum card is a reimbursem*nt for paying more than the total balance owed on the card. For example, a cardholder who has a balance of $500, but pays $600, can get a credit balance refund of the $100 that they overpaid

13. Why is my pending transaction showing as “AMERICAN EXPRESS ...

Some times when full merchant details can't be captured at the time of transaction a default value of “AMERICAN EXPRESS INTERNAL TRANSACTION” will be ...

Some times when full merchant details can’t be captured at the time of transaction a default value of “AMERICAN EXPRESS INTERNAL TRANSACTION” will be displayed. Once the transaction is confirmed and processed by the system you will see the correct merchant name appear on your timeline and statement – this process normally takes 1-3 days but can take as long as 7 days to fully process.If you are still concerned by the incorrect name once the transaction appears with an amount on your timeline ...

14. What should I do if I have a question about a charge on my Account ...

Follow the prompts to open a dispute case. Online Disputes are available to Personal and Small Business Cards only. Call American Express Customer Service. We ...

If you are unable to resolve your inquiry with the merchant directly, please contact us at the number on the back of your Card or you may set up a dispute online by logging in to your Online Services Account (Personal and Small Business Cards only). We will take all reasonable and appropriate steps to provide the information you request or attempt to resolve the billing dispute on your behalf. Some potential reasons you might need to open a dispute are an unexpected charge, you have been bil...